The early childhood educator’s role of shaping young lives is both powerful and essential. Those starting out in the ECE field and those who are already invested can amplify that impact and open doors to new skills, deeper knowledge, and greater career opportunities with higher education. But while college and professional development can be transformative, the cost of it all can present itself as a barrier.

Thankfully, there are various financial aid resources available to support your journey, from grants and scholarships to work-study programs and student loans. Two key pathways, the Free Application for Federal Student Aid (FAFSA) and the California Dream Act Application (CADAA), help eligible students access the funding they need. In addition, the Workforce Pathways Grant provides targeted support for those already working in early childhood education, helping students grow professionally while continuing to serve their community.

Understanding these options is the first step toward making higher education and professional growth both accessible and achievable.

Financial Aid Opportunities

Financial aid opportunities exist for just about every kind of college student. Whether you are just starting your college journey or are signing up for more classes to enhance your current career, there are options! The Free Application for Federal Student Aid (FAFSA) is foundational for many of these options.

What is FAFSA?

The FAFSA is a free form that students fill out to see if they qualify for financial aid for college or career school including:

- Grants (free money you don’t repay)

- Some scholarships (many colleges and states use FAFSA info to award their aid too)

- Federal student loans (which must be paid back, often with low interest)

- Work-study programs (part-time jobs for students with financial need)

Filling out the FAFSA is the first step to getting financial help for college. The U.S. Department of Education and your college use the information to decide how much aid you’re eligible for. You will have to fill out the FAFSA form every year you’re in school to stay eligible for federal student aid. (Keep reading for a detailed application how-to.)

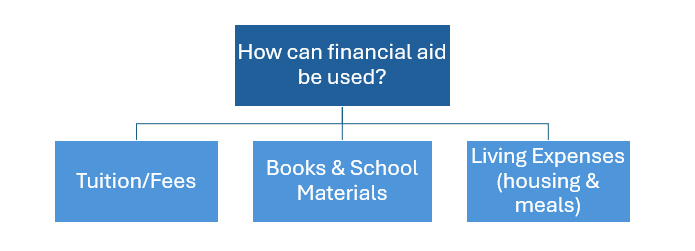

Keep in mind: Funds are applied directly to your tuition and fees first. Any leftover money (called a refund) is sent to you for books, housing, or other expenses.

Grants vs. Student Loans vs. Scholarships

When it comes to paying for college, knowing the financial aid options can make all the difference. Three of the most common ways students fund their education are through grants, student loans, and scholarships, but each works very differently. Some provide free money you don’t have to repay, while others must be paid back with interest. In this section, we’ll break down the key differences, benefits, and things to watch out for so you can make smart, confident choices about how to pay for your education.

Grants

What is a grant? A college grant is a form of financial aid that helps students pay for college — and does not have to be repaid. Think of it as free money awarded based on financial need, though some grants may also consider factors like academic performance or special circumstances.

Federal Pell Grant:

If you are an undergraduate student working towards your first degree you may be eligible for a Pell Grant. Pell Grant is a federal grant that does not need to be repaid unless a student withdraws from school. To be considered for Federal Pell Grant, students must complete the FAFSA and the amount offered is based on financial need. The amount you get will depend on:

- Your Student Aid Index (based on your FAFSA form)

- The cost of attendance (determined by your school for your specific program)

- Your status as a full-time or part-time student

- Your plans to attend school for a full academic year or less

Click here to apply for Federal Pell Grant and to learn more!

Cal Grant:

The Cal Grant is a California-specific financial aid for students attending University of California, California State University or California Community College, or other qualifying schools. There are two different Cal Grant types.

- Cal Grant A provides need-based grant funds to low and middle-income students to offset tuition/fee costs for students. Eligibility is based on grade point average and financial need. The amount of the award is based on the number of units the student is enrolled in (at least 6).

- Cal Grant B provides need-based grant funds to high-potential students from low-income, disadvantaged families to help offset tuition/fee and other costs. It pays a subsistence stipend (living allowance) to assist with non-tuition costs (living expenses, books, etc.) for grant recipients in their first year. Recipients in subsequent years of study receive the stipend as well as an award to offset fees.

Students with Dependents: If you’re a student parent with children under 18, you could qualify for extra financial support through an increased Cal Grant — helping you balance school and family with less financial stress.

Learn more about Cal Grants here!

Chafee Grant:

The California Chafee Grant Program gives free money to current or former foster youth enrolled in vocational school or college courses at least half-time and making satisfactory academic progress. Eligible students must:

- Be a current or former foster youth who was a ward of the court, living in foster care, or between the ages of 16 and 18.

- Not have reached their 26th birthday as of July 1st of the award year.

- Be enrolled in an eligible vocational school or college courses at least half-time.

- Be making satisfactory academic progress.

Click here to apply for a Chafee Grant!

College grants are a great way to get free money for school — no repayment required. By applying early and completing the FAFSA, you can unlock valuable financial support to help you reach your goals with less debt. Don’t miss out!

To check out other grants offered in California, click here.

Workforce Pathways Grant

The Workforce Pathways Grant is a funding program designed to support individuals working in early childhood education (ECE) by helping them pursue professional development, training, and education. The goal is to strengthen and retain the early childhood workforce, which plays a critical role in children’s development during their most formative years.

Who is eligible for the QCC Workforce Pathways Grant?

- Work in San Bernardino County directly with children birth up to 5 years of age.

- Work in one of the following settings; Family Child Care home, Family Friend and Neighbor (FFN), School-based or Center-based program.

- Work in a paid capacity directly and consistently with children, in a classroom at least 15 hours a week. (substitutes and personnel on leave, do not meet this requirement.)

- Earn less than $85,000 annually.

- Maintain continuous employment, in the classroom with the same agency nine of the twelve most recent months prior to receiving the stipend and employed with the agency when the funds are received.

What does the QCC Workforce Pathways Grant typically offer?

- Tuition assistance for college courses or credential programs (such as Child Development permits or degrees).

- Stipends or bonuses for completing professional development hours or education milestones.

- Support services, such as career advising or mentoring.

How to find grant opportunities?

- Log into CA ECE Workforce Registry or create a new account

- Click on “Stipends & Pathways”

- Locate the county in which you plan to apply for a stipend (if you are not sure please contact your local county stipend administrator)

- Click on Application and begin the process

How to get reimbursed for your college courses?

Loans

A loan is money you borrow and must pay back with interest. If you apply for financial aid, you may be offered loans as part of your school’s financial aid offer. When you receive a student loan, you are borrowing money to attend a college or career school. You must repay the loan as well as interest that accrues. The loans awarded are either subsidized, unsubsidized, or a combination of both. The type and amount of loans offered will be determined by a student’s financial eligibility, dependency status, grade level, and overall aggregate limits of previously borrowed funds. There are two types of standard college loans.

Subsidized Loan

A subsidized loan is a government insured, long term, low interest loan for eligible undergraduate students and is awarded on the basis of financial need. The federal government will pay (subsidize) the interest on the loan while the student remains enrolled in college at least half-time or more. Graduate students are not eligible to borrow a Subsidized Loan.

- Subsidized Loans are available to undergraduate students with financial need.

- Your school determines the amount you can borrow, and the amount may not exceed your financial need.

- The U.S. Department of Education pays the interest on a Subsidized Loan:

-

- While you’re in school at least half-time

- For the first six months after you leave school (referred to as a grace period*)

- During a period of deferment (a postponement of loan payments).

-

Unsubsidized Loan

An Unsubsidized loan is a government insured, long term, low interest loan for eligible undergraduate and graduate students. It is generally offered to students who do not qualify for need based aid or who need loan assistance beyond the maximums provided by the Subsidized Loan program. Unlike a subsidized loan, the borrower is responsible for paying the interest from the time the unsubsidized loan is disbursed until it’s paid in full. Borrowers have the option of paying the interest or deferring it while in college. If borrowers choose to defer the interest, it will be capitalized, which means it is added to the principal amount borrowed. Future interest will be calculated on the higher loan amount. It is to a borrower’s advantage to pay the interest while attending college. Graduate students are only eligible for Unsubsidized Loans.

- Direct Unsubsidized Loans are available to undergraduate and graduate students; there is no requirement to demonstrate financial need.

- Your school determines the amount you can borrow based on your cost of attendance and other financial aid you receive.

- You are responsible for paying the interest on a Direct Unsubsidized Loan during all periods.

Subsidized and unsubsidized loans can help bridge the gap when grants and scholarships aren’t enough. While both offer support, subsidized loans are the better option if you qualify, since the government pays the interest while you’re in school. Apply through the FAFSA, borrow only what you need, and stay informed to manage your loans wisely.

To gain more information on Subsidized & Unsubsidized Loans, click here!

Loan Repayment

After you graduate, leave school, or drop below half-time enrollment, you will have a six-month grace period before you are required to begin repayment. During this period, you’ll receive repayment information from your loan servicer, and you’ll be notified of your first payment due date. Payments are usually due monthly. Click here to learn more about Federal Student Loan Repayment Plans.

Loan Deferment

If you are unable to make your scheduled loan payments, contact your loan servicer immediately. Your loan servicer can help you understand your options for keeping your loan in good standing. For example, you may wish to change your repayment plan to lower your monthly payment or request a deferment or forbearance that allows you to temporarily stop or lower the payments on your loan. Learn more about Loan Deferment here.

Scholarships

A scholarship is a form of financial aid that helps pay for college and does not need to be repaid, making it essentially free money. Scholarships are awarded for a variety of reasons, including academic achievement, athletic talent, community service, artistic ability, intended field of study, or financial need. They can come from colleges, private organizations, nonprofits, and businesses, each with its own set of requirements. Many students qualify for more than one scholarship, and they can often be combined with grants and loans to further reduce college costs. Applying for scholarships is a smart way to ease the financial burden of higher education and avoid unnecessary debt.

Scholarships available at colleges in the Inland Empire:

- Barstow Community College Scholarships

- Cal Poly Pomona Scholarships

- California State University San Bernardino Scholarships

- Chaffey College Scholarships

- College of the Desert Community College Scholarships

- Copper Mountain Community College Scholarships

- Crafton Hills College Scholarships

- Norco Community College Scholarships

- Riverside Community College Scholarships

- San Bernardino Valley College Scholarships

- Victor Valley Community College Scholarships

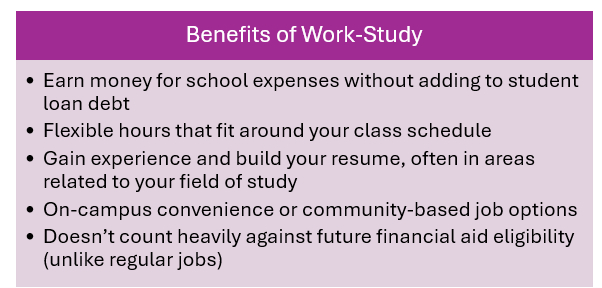

Federal Work Study Programs

Work-study is a federally or state-funded program that places eligible students in part-time jobs—often on campus or with approved community organizations. The wages earned go directly to the student. To qualify for work-study, you must:

- Be a U.S. citizen or eligible noncitizen.

- Be enrolled in a college or university that participates in the Federal Work-Study Program.

-

- Check with your school’s financial aid office to find out if your school participates in Federal Work-Study Program.

-

- Demonstrate financial need (based on the Free Application for Federal Student Aid, or FAFSA)

How to apply for Work-Study

- Fill out the FAFSA: Be sure to check the box that says you’re interested in work-study.

- Wait for your financial aid award letter, which will say whether you qualify for work-study.

- If eligible, you’ll usually apply for work-study jobs through your college’s career center or student employment office.

Work-study is a valuable opportunity for students who need financial assistance and want to earn money while gaining job experience during college. Applying early and checking the right box on your FAFSA can help you take advantage of it.

To learn more about Federal Work-Study Programs, click here!

The California Dream Act

The California Dream Act (CADAA) is a state law that allows undocumented and certain nonresident students to access financial aid for college in California, similar to what U.S. citizens and permanent residents receive through FAFSA. So, while undocumented students are not eligible for federal financial aid or the FAFSA, they are eligible for state financial aid through the CADAA. The CADAA allows eligible undocumented students to:

- Pay in-state tuition at public colleges and universities in California

- Apply for state-funded financial aid, including:

-

- Cal Grants

- Chafee Grants

- UC and CSU institutional aid

- Community college fee waivers

- Some scholarships

-

Note: This act does not give legal immigration status, but it helps make college more affordable for undocumented students.

Student qualifications for the CADAA:

- Be undocumented or a nonresident who qualifies under AB 540, which means they:

-

- Attended a California high school for at least 3 years

- Graduated from a California high school or earned an equivalent (like a GED)

- Enroll in an accredited California college or university

-

- Submit a signed nonresident exemption affidavit (promising to apply for legal status when eligible)

- Students with Temporary Protected Status (TPS), U Visa holders, DACA recipients, and other eligible statuses may also qualify.

How to Apply for the CADAA:

- Fill out the California Dream Act Application

- Submit your CADAA by April 2nd every year! Students attending a California Community College can apply by September 2nd.

- Submit the nonresident tuition exemption (AB 540 affidavit) to your school.

- Provide any supporting documents the college or California Student Aid Commission requests.

What happens next after I submit my application?

- Review the Confirmation Page to identify and fix any errors.

- California Student Aid Commission (CSAC) will email you a nine-digit “Dream ID number” that you will need to create a WebGrants 4 Students account to check the status of your application, eligibility for Cal Grant and Middle Class Scholarship, and any next steps.

- CSAC will send your CADAA to all the colleges that you listed on the application to determine what types of financial aid you are eligible for!

Will I put myself or my family at risk by applying for financial aid?

No! If you are undocumented, you may feel nervous about completing a government application for financial aid. However, California has a financial aid application process designed to help and protect undocumented students and families. The information you provide when you complete the CADAA is never shared with any federal agencies and is only used to determine your eligibility for financial aid offered by the state and colleges in California.

To learn more about the California Dream Act click here!

Tips for Applying for FAFSA

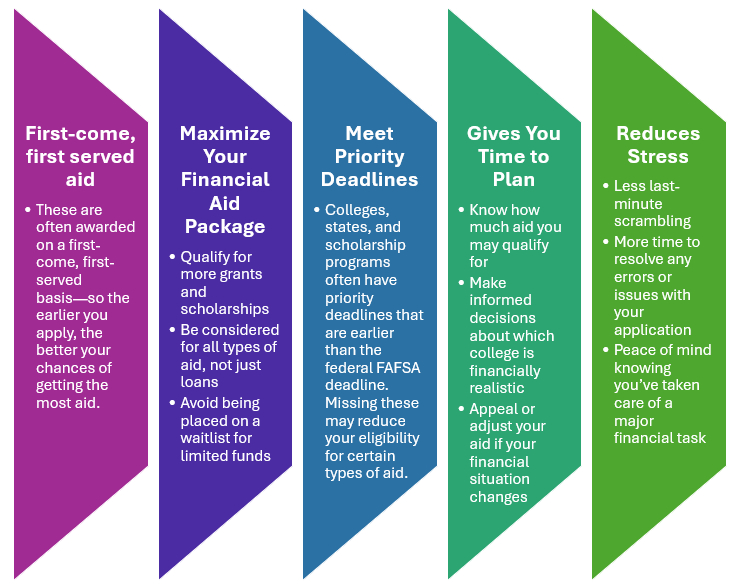

Apply Early. This is one of the most important financial planning steps you’ll take. The recommendation is to file as soon as FAFSA applications open, this is typically October 1st (however the date is subject to change). The earlier you apply for FAFSA, the more money and options you may have. Don’t leave free money on the table! Here’s why applying early matters:

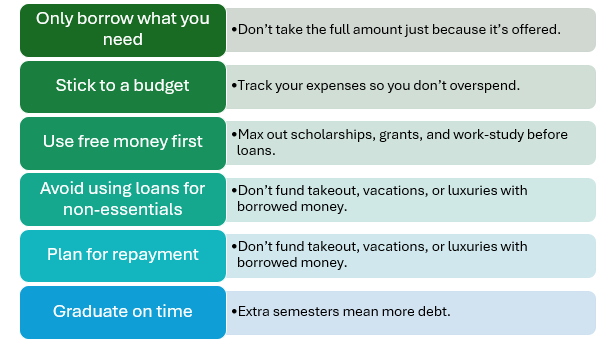

Borrow Wisely. Although a loan provides a convenient and often necessary source of additional funding for education, it is crucial to remember that it is still a loan that must be repaid. As such, it is essential for students and families to budget thoughtfully and borrow with intention to avoid unnecessary debt and long-term financial strain.

Remember: You are obligated to repay your loan regardless of whether you complete your education, are satisfied with your education, or can find a job.

How to Apply for FAFSA?

Step 1: Complete the Application Form

The application, found here, usually opens October 1 each year although this date is subject to change. The Federal deadline is typically June 30, but state and college deadlines may be much earlier. Make sure to check with your school.

What You’ll Need:

- Your Social Security Number (or Alien Registration Number if you’re not a U.S. citizen)

- Federal tax returns, W-2s, and other financial documents

- Information about your assets and untaxed income

- If you’re a dependent student, include your parents’ information

Determine dependent vs. independent status on the FAFSA

Your dependency status determines whose financial information you must report on the FAFSA. It’s not based on whether you live with your parents or whether they claim you on their taxes—it’s about your answers to specific FAFSA questions. If you’re a dependent student, you must provide both your own and your parents’ financial information on the FAFSA. You’re considered dependent unless you meet one of the independent criteria listed below.

If you’re an independent student, you only provide your own financial information (and your spouse’s, if married). Your parents’ information is not required.

You are considered independent if at least one of the following is true:

- You are 24 years old or older by January 1 of the school year you’re applying for

- You are married

- You are pursuing a graduate or professional degree

- You have children or other dependents who receive more than half of their support from you

- You are a veteran or currently serving on active duty

- You were in foster care, a ward of the court, or emancipated at any time since turning 13

- You are or were homeless or at risk of homelessness

- You are an orphan (both parents deceased)

- If none of these apply, you are considered dependent, even if your parents do not support you financially.

Step 2: Create a Federal Student Aid (FSA) ID

- You will need to create an FSA ID to sign your FAFSA electronically. One ID is needed for the student and another for one parent (if dependent).

Step 3: Submit the FAFSA

- Add your prospective or current colleges’ school codes in the FAFSA so they can receive your info.

- Submit as early as possible—some aid is awarded on a first-come, first-served basis.

Step 4: Review Your Student Aid Report (SAR)

Once your FAFSA is processed, you’ll receive a Student Aid Report (SAR) that summarizes your information and includes your Expected Family Contribution (EFC) or Student Aid Index (SAI).

- Review for accuracy

- Make any necessary corrections

Step 5: Follow Up with Your College(s)

Each college’s financial aid office will use your FAFSA data to put together a financial aid package, which may include:

- Grants (e.g., Pell Grant, state grants)

- Scholarships

- Federal student loans

- Work-study opportunities

Check your college’s student portal or website for required forms, verification steps, and offer acceptance.

Receiving FAFSA

Review your FAFSA Award Letter.

-

- After applying, colleges will send a financial aid offer letter.

- This will include grants, work-study, scholarships, and loan options.

- Accept only the aid you need—you can decline loans if you don’t want to borrow.

When to Expect FAFSA?

- FAFSA Award Letters typically arrive late winter to early spring (January–April), once you’ve been accepted to a college.

- FAFSA Disbursement (when you get the aid) usually occurs at the beginning of each semester.

Pursuing higher education or professional development as an early childhood educator is not just an investment in yourself — it’s an investment in the children and families you support every day. With resources like FAFSA, the California Dream Act, and the Workforce Pathways Grant, financial support is within reach, no matter your background or immigration status.

By taking the time to explore and apply for these opportunities, you’re opening the door to continued learning, career advancement, and a stronger early childhood workforce. Your dedication to growth matters and there are tools in place to help you thrive.

This blog is one of a 5-part series designed to support and guide early childhood educators on their college journey. From choosing the right program to managing finances and hearing real stories from the field, each post will help you take the next step with confidence. Make sure to read them all:

- Higher Education Programs and Permits – Local available programs plus the Child Development Permit process.

- Classroom Compass – What to expect in college classes and how to apply

- Find Your Fit – Discovering the right college match for your goals

- Funding Your Future – Tips and tools to pay for college

- Stay tuned for Real Talk – Hear from fellow educators on balancing work, life, and learning